18+ Current refi rates

Get a mortgage Quote Our Client Reviews Google Rating 49Based on 557 reviews Handshake Home Loans Inc. The 30-year fixed-rate mortgage is 18 basis points higher than one week ago and 328 basis points higher.

Vgak4umwljsgbm

Lock-in Redmonds Low 30-Year Mortgage Rates Today.

. Compare FHA refinance rates. The current rate for a 15-year fixed-rate mortgage is 521 with 09 points paid an increase of 005 percentage points higher week-over-week. An FHA refinance loan is a refinance insured by the Federal Housing Association.

The 15-year rate averaged 212 this week last year. Compare free APRs from top lenders to find the best fixed or adjustable rate mortgage for you. You will receive unmatched service a fast closing and a great rate.

49Jodie Traslavina1515 29 Jun 22Nick and Tyler were amazing they helped me through the whole. Looking for the current SBA 504 loan rates or the SBA 504 rate history. The terms and conditions of refinancing may vary widely by country province or state based on several economic factors such as inherent risk projected risk political stability of a nation currency stability banking regulations borrowers credit.

As a borrower you can choose to pay points at closing in addition to the standard third-party and lender fees in order to secure a. 2022 109 AM Mortgage Purchase Rates Mortgage Refi Rates Vehicle Loans Rates Personal Loans Rates Home Equity Rates Student Loans Rates Credit Cards Rates Save Invest Rates. 5 years fixed 1 year adjustable 51.

028 APY 12 Months. Check our rates and lock in your rate. The national average annual percentage rate APR on a 30-year fixed mortgage refinance on December 3 2021 is 331 while the 15-year fixed mortgage refinance is 266.

025 APY 9 Months. A conventional loan for example usually requires a credit score of 620 or higher. The current rate on a 51 adjustable-rate mortgage is 493 with 02 points paid 029 percentage points higher than a week ago.

With 30-year fixed mortgage rates around 5 replacing your current mortgage with a new one through a cash-out refinance may not be the most advantageous option and a reverse mortgage doesnt. You Deserve A Better Mortgage Experience Experience the Handshake difference. Are mortgage rates going up or down.

Heres the current SBA 504 loan rates and history updated monthly. Down Payment or. Purchase Refinance Cash Out Refi.

How much money could you save. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Since the start of 2022 mortgage rates have risen quickly.

NerdWallets comparison tool can help you find the current refinance rates for your. The 15-year rate averaged 216 a year ago. Youll notice a points column in the current mortgage rates table above.

Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. These rates can be an entire point lower than 30 year fixed rates. Filters enable you to change the loan amount duration or loan type.

View 30-year and 15-year fixed rates and ARMs in your area. And 7 years fixed 1 year adjustable 71. Unfortunately as the year progresses rates may increase even.

Current Rates Current Rates. The current rate on a 51 adjustable-rate mortgage is 439 with 03 points paid a decrease of 004 percentage points from a week ago. Therefore there may be significant savings in terms of interest paid to the lender.

The 15-year rate averaged 219 a year ago this week. By default 30-yr fixed-rate loans are displayed in the table below. Your credit score will be a factor in your refi options as will the type of home loan youre pursuing.

A point is equal to one percent of the loan amount. Some common hybrid ARMs are 1 year fixed 1 year adjustable rates 11. The current rate for a 15-year fixed-rate mortgage is 516 with 08 points paid 018 percentage points higher week-over-week.

The current rate for a 15-year fixed-rate mortgage is 455 with 07 points paid decreasing by 004 percentage points over last week.

Appraisals Check The Water Source Appraisal Today

What You Should Do Before Interest Rates Rise Mortgage Interest Rates Mortgage Interest Interest Rate Rise

Loaddocument Php Fn Agencymbs0419ex5 Png Dt Fundpdfs

Rate Hikes Alter Single Family Strategies For Investors

Price Per Square Foot Not Very Reliable For Appraisals Appraisal Today

Affordability Page 2 Of 7 Realtor Com Economic Research

Infographics Keeping Current Matters Mortgage Rates Mortgage Mortgage Interest Rates

Historic 30 Year Fixed Mortgage Interest Rate Graph Mortgage Rates Current Mortgage Rates Mortgage

Affordability Page 2 Of 7 Realtor Com Economic Research

Today S Mortgage Rates August 18 2022 Mortgage Rates Move Upward Forbes Advisor

Affordability Page 2 Of 7 Realtor Com Economic Research

Today S Mortgage Rates August 18 2022 Mortgage Rates Move Upward Forbes Advisor

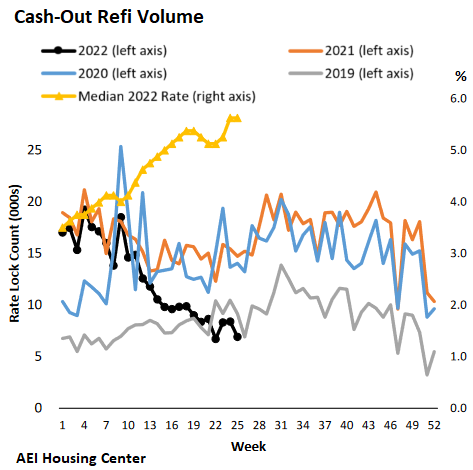

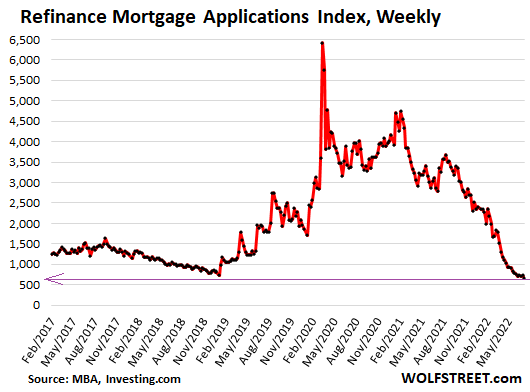

Cash Out Refis With Holy Moly Mortgage Rates For Remodeling Projects Professional Home Remodelers Face New Challenges Wolf Street

Weekly Indicators Mortgage Rates And Gas Prices Pressure Consumers Seeking Alpha

Why The New Inflation Report Is Sending Stocks Higher

Affordability Page 2 Of 7 Realtor Com Economic Research

Cash Out Refis With Holy Moly Mortgage Rates For Remodeling Projects Professional Home Remodelers Face New Challenges Wolf Street